pay utah corporate tax online

The minimum tax if 100. LLCs operating in Utah that elect for taxation as corporations are responsible for paying this.

Property Tax Payment Information.

. Running a small business can be so much fun but you do have to pay your Utah small business taxes. For security reasons our e-services TAP OSBR etc are not available in most countries outside the United States. The corporate income tax in Utah is generally a flat rate of 5 percent of the taxable income of the business.

Go to Taxpayer Access Point and create a TAP login to file and pay your Utah business taxes. What You Need To Pay Online. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

You can also pay online and avoid the hassles of mailing in a check. Like nearly every other state Utah requires corporations to pay a corporate income tax which is also referred to as the corporation franchise and income tax. Filing Paying Your Taxes.

If a credit card is used as the method of. For security reasons TAP and other e-services are not available in most countries outside the United States. What you need to pay online.

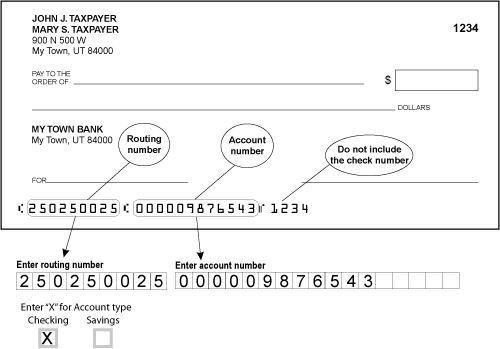

If you have questions about your property tax bill or want to make a payment see this document. You will need your property serial number s. To set up automatic monthly payments for a specified amount directly from your bank account mail the Automatic Transfer Form to the OSDC.

Please note that our offices will be closed November 25 and November 26 2021 for the Thanksgiving Holiday Pay over the phone by calling 801-980-3620 Option 1 for real property. If you do not have these please request a duplicate tax notice here. Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT.

Here is a guide on how that process works. There will be a 300 fee to enroll in this service and you will be asked to renew at the end of 12 months. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. Taxpayer Access Point TAP Register your. To pay Real Property Taxes.

Business identity theft is a very real concern in todays marketplace because from a criminals perspective it is significantly more cost-effective to steal business identities than consumer identities said Steve Cox BBB spokesperson. Payment Types Accepted Online. Rememberyou can file early then pay any amount you owe by this years due date.

It does not contain all tax laws or rules. To make an online payment using a CreditDebit Card or a Personal Check access our online payment site at EZpayutahgov.

Utah Income Taxes Utah State Tax Commission

Quality Automotive In Utah Is For Sale With Over 4800 Square Feet And Easy Access To I 15 And Downtown Salt Lake City 3 Salt Lake City Downtown Utah Property

Utah Sales Tax Small Business Guide Truic

Tax Dashboard Dark Theme Dark Tax Software Dashboard

Utah State Tax Commission Official Website

Income Tax Of India Income Tax Online Education One Liner

Utah Divorce Lawyers Www Lawandamerica Divorce Lawandamerica Ventos Div Divorce Lawyers Divorce Lawyers Lawyer Utah Divorce

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Investing In The Future Of Utah Premium Wordpress Themes Investing Wordpress Theme

Utah State Tax Benefits Information

Tax Offices In Utah Tax Help Utah Internal Revenue Service

Download Payment Agreement Template 23 Payment Agreement Contract Template Agreement

I Made Some If You Like Hillary Sharables For Facebook What Do You Think Learn Spanish Online Free Spanish Lessons Learning Spanish

2021 Contribution Limits Increase For Utah Income Tax Credit Or Deduction

Child Support Liens In Utah What You Need To Know Child Support Child Support Laws Supportive

Utah State Tax Commission Official Website

Composition Of State And Local Tax Rev Income Tax Government Taxes Revenue