tax on unrealized gains canada

6 ways to avoid capital gains tax in Canada. This means that only half of your capital gains will be taxed by the CRA.

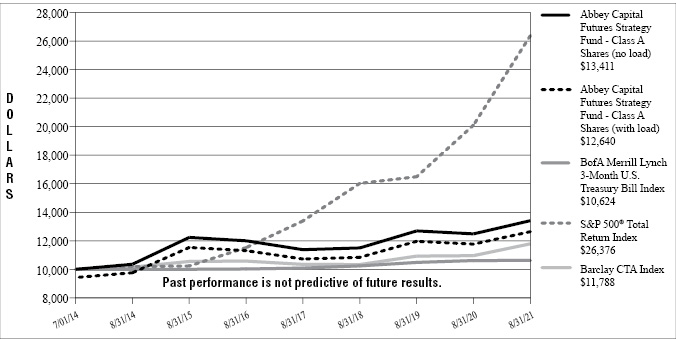

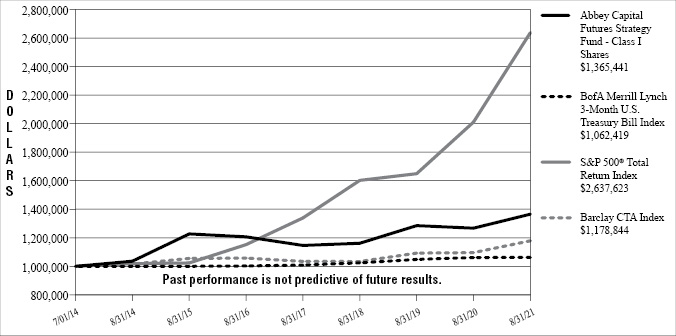

As Filed With The Securities And Exchange Commission On 11 4 2021 United States Securities And Exchange Commission Washington D C 20549 Form N Csr Certified Shareholder Report Of Registered Management

So for example if you buy a stock at 100 and it earns 50 in value when you sell it the total capital gain amount is 50.

. Households worth more than 100 million as part of his. Want to get an idea of what your capital gains tax looks. You report the disposition of capital property in the calendar year January to December you sell or are considered to have sold the property.

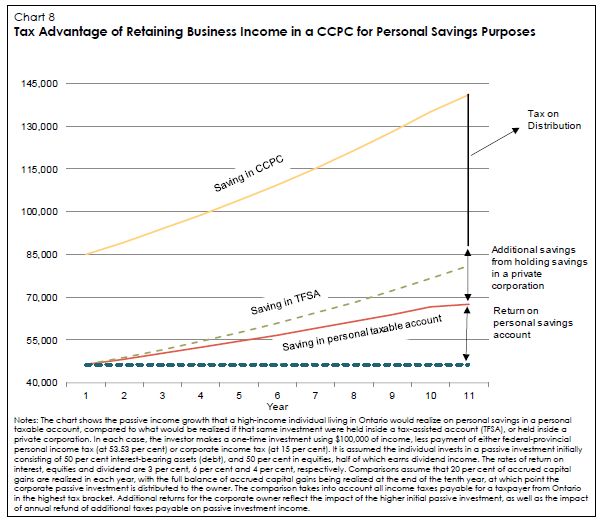

For an Ontario resident the combined Federal and Ontario tax rate applicable to a high rate taxpayer is 268 which compares favorably to salary at 535 and non-eligible dividends at 453. You can buy and sell stocks at your leisure with no tax consequences. It is a profitable position that has yet to.

The taxes in Canada are calculated based on two critical variables. 30 2021 Published 1040 am. 333 Bay Street Suite 2601 Toronto Ontario M5H 2R2 General.

The capital gains tax is the same for everyone in Canada currently 50. Tax shelters act like an umbrella that shields your investments. Unrealized gains and losses on foreign exchange please contact a member of the EPR Maple Ridge Langley team by filling out the contact form below.

When you gain profit from the sale of investments such as stocks bonds debt land or buildings you have made capital gains. In February 1994 the then-Liberal government of Prime Minister Jean Chrétien and Minister of Finance Paul Martin cancelled the 100000 lifetime. So if you have realized capital gains of 200 you will get to.

In this commentary we discuss the findings from our new research on the estimated impact of the 1994 reform that dramatically increased the tax rate on capital gains income for most Canadians. 50 of the value of any capital gains are taxable. Earlier this week the president proposed a minimum 20 percent tax rate that would hit both the income and unrealized capital gains of US.

Canadian and foreign tax laws are complex and have a tendency to change on a frequent basis. Because of this the actual amount of extra tax you owe will vary according to your earnings and other income sources. Your sale price 3950- your ACB 13002650.

As such the content published above is believed to be. The inclusion rate is 50 so you add half of that gain 558308 to your total income for the year. You deduct your exemption of 883384 to get a 1116616 taxable capital gain.

To calculate your capital gain or loss simply subtract your adjusted base cost ABC from your selling price. How are capital gains taxed in Canada. Canadians pay a 50 tax on all of their capital gains.

In response Budget 2016 proposed new rules that would prevent taxpayers from treating certain derivatives held on income. The Queen 2015 TCC 119. Put your earnings in a tax shelter.

Current Capital Gain Tax. And the tax rate depends on your income. For example if you buy a house for 200000 and the value goes up to 210000 your basis is 200000 and you have a 10000 unrealized gain.

The sale price minus your ACB is the capital gain that youll need to pay tax on. This capital gains tax reduction doesnt apply for day traders who pay 100 tax on income from capital gains. As the rules are currently written only 50 of a capital gain is subject to tax in Canada.

Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates. The inclusion rate refers to how much of your capital gains will be taxed by the CRA. You would pay the marginal tax rate on the 50 capital gain in this case 25.

This investor would face taxes on just 1000 of. When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. Youll pay capital gains tax in Canada on the difference when you buy a share and then sell it for a higher price.

On a capital gain of 50000 for instance only half of that amount 25000 is taxable. Since its more than your ACB you have a capital gain. An unrealized gain is a profit that exists on paper resulting from an investment.

This treatment was supported by the 2015 decision of the Tax Court of Canada in Kruger Inc. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset. In our example you would have to include 1325 2650 x 50 in your income.

If you have any questions about realized vs. If the value drops to 190000 you have a 10000. As long as your investments remain inside a tax shelter they are left to flourish duty-free.

Because businesses have to use at least 90 of their assets in an active business operating primarily in Canada to qualify consider selling the business at a time. The first issue is that under the existing rules capital gains are only included in income for tax purposes when an item is sold and the gains are realized which implies that the seller receives a profit because of the sale of the asset. So here are a few pointers about taxes on.

In Canada 50 of the value of any capital gains is taxable. When to report a gain or loss. If you buy a share for 1000 and sell it for 2000 you.

ITA while having no corresponding requirement to include unrealized gains in computing income. This means that if youve made 5000 in capital gains 2500 of those earnings need to be added to your total taxable income. Regardless of whether or not the sale of a capital property results in a capital gain or loss you have to file an income tax and benefit return to report the.

Divide that number in half 50 and that. In Canada you only pay tax on 50 of any capital gains you realize. Now lets assume that Investor A is entitled to todays 50-per-cent inclusion rate on capital gains.

For now the inclusion rate is 50. What Does the Proposal To Tax Unrealized Capital Gains Mean for Americans. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax-free.

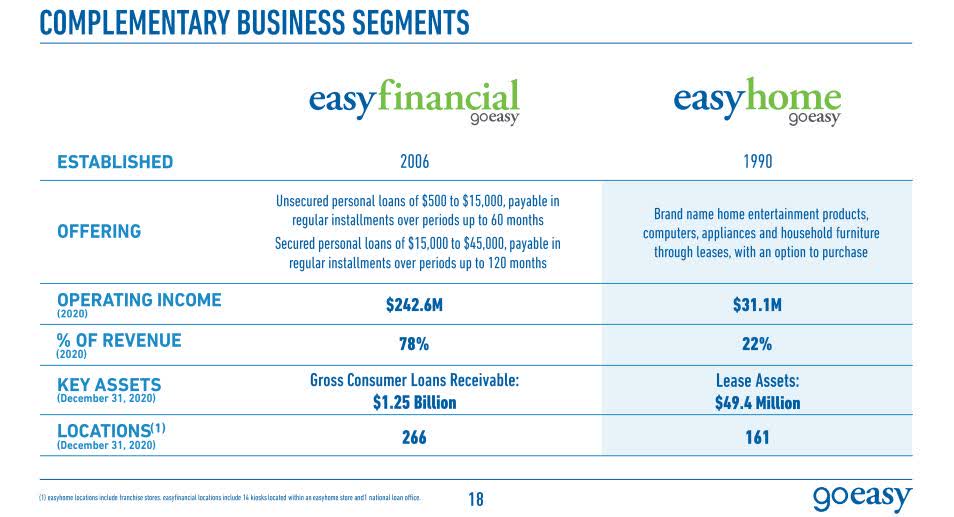

Goeasy One Of The Best Canadian Stocks To Buy Ehmef Seeking Alpha

Cryptocurrency Taxes Canada 2022 Guide Finder Canada

Bitcoin On Twitter Fyi Many Countries Implement A Wealth Tax Or Something Like An Unrealized Capital Gains Tax Examples Argentina 5 25 Canada 0 4 France 1 5 Spain 3 75 Netherlands 1 2 Norway 0 85 Switzerland

Departmental Results Report 2020 21 Global Affairs Canada

20 F 1 Tm205933d1 20f Htm 20 F United

Annual Audited Consolidated Financial Statements And Md Amp A

Blog And Articles Cardinal Point Wealth Management

Namaste Technologies Reports Second Quarter 2021 Financial

2021 2022 Income Tax Calculator Canada Wowa Ca

As Filed With The Securities And Exchange Commission On 11 4 2021 United States Securities And Exchange Commission Washington D C 20549 Form N Csr Certified Shareholder Report Of Registered Management

Capital Gains Tax Changing In Canada

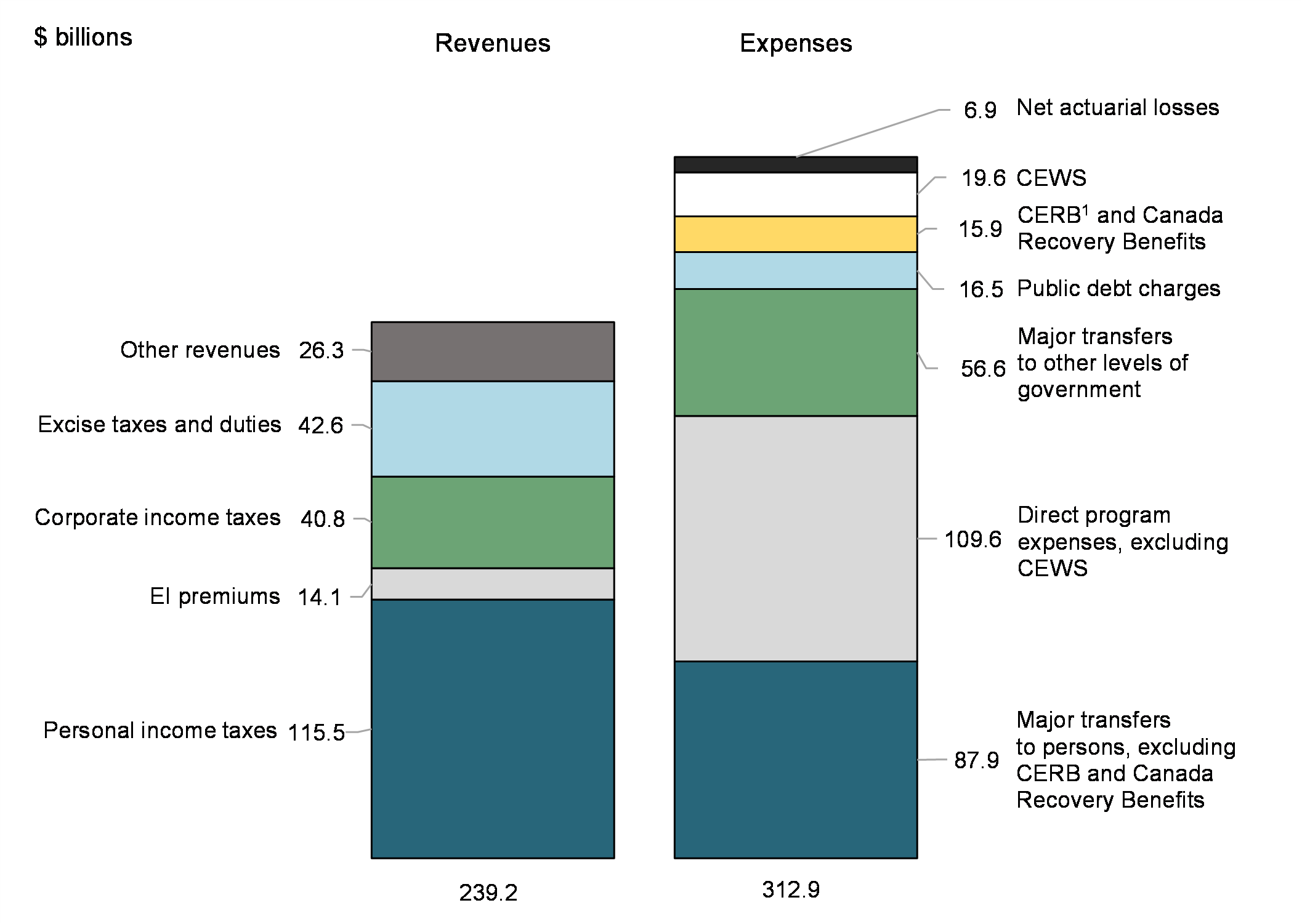

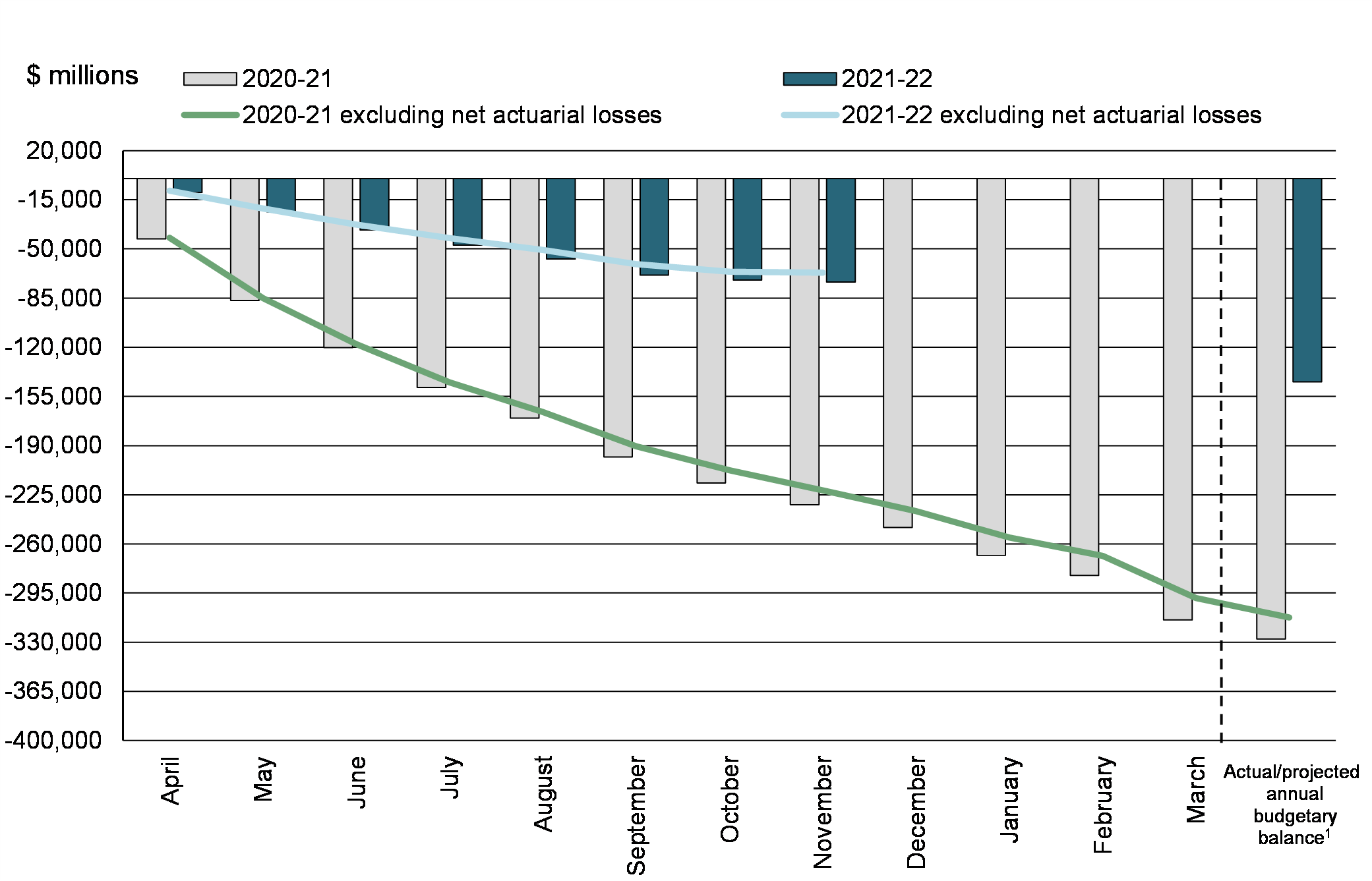

The Fiscal Monitor November 2021 Canada Ca

The Fiscal Monitor November 2021 Canada Ca

Is It Time To Re Examine Your Corporate Structure Corporate Tax Canada

Informatica Reports Fourth Quarter And Full Year 2021 Financial Results Informatica Canada